Tax Credit Update

The current $8,000 tax credit for first-time homebuyers expires at the end of November. Read more on our October posting entitled

"Tax Credit Extension Moves One Step Closer"

Existing Home Sales Surged in September

Existing home sales jumped 9.4% in September to an annual rate of 5.57 million homes, which is the highest rate in more than two years. Read more on our October posting entitled

"Existing Home Sales Jump, New Home Sales Drop"

Friday, October 30, 2009

Thursday, October 29, 2009

Tax Credit Extension Moves One Step Closer

The Senate just moved the home buyer tax credit a step closer to an extension (and expansion), according to a news report today from CNBC.

Enactment of the extension is still quite a ways off, but the Senate has reportedly reached a compromise on what the tax credit provision would look like going forward.

The first-time buyer credit of up to $8,000 (or 10% of the purchase price, whichever is less) would be extended until April 30, 2010.

The program is also slated for expansion. If passed it would provide a benefit to people who have owned and lived in a primary residence for five consecutive years out of the past eight. These buyers would have a $6,500 tax credit.

A lot of political maneuvering must still occur before this is a done deal. Senate leaders want to attach the tax credit provision to a bill that would extend unemployment benefits.

If the Senate does act favorably, the House must take action. So stay tuned. We will keep you updated as this moves its way through Congress.

Enactment of the extension is still quite a ways off, but the Senate has reportedly reached a compromise on what the tax credit provision would look like going forward.

The first-time buyer credit of up to $8,000 (or 10% of the purchase price, whichever is less) would be extended until April 30, 2010.

The program is also slated for expansion. If passed it would provide a benefit to people who have owned and lived in a primary residence for five consecutive years out of the past eight. These buyers would have a $6,500 tax credit.

A lot of political maneuvering must still occur before this is a done deal. Senate leaders want to attach the tax credit provision to a bill that would extend unemployment benefits.

If the Senate does act favorably, the House must take action. So stay tuned. We will keep you updated as this moves its way through Congress.

Olympia in the Fall

The ground is covered with a layer of wet yellow leaves and it is spectacular. Bright colors, crisp clean air, foggy mornings, Olympia is a great place to live!

One of our favorite places to visit this season is Tumwater Falls Park. This 15 acre park is located on the last quarter mile of the Deschutes River. Enjoy the beautiful fall colors along the one-half mile of trails, picnic in the park and enjoy nature. Tuwmater Falls Park is located on "C" St & Deschutes Way Tumwater, WA 98501.

Don’t forget your camera when you are out and about! You don’t want to miss what Mother Nature has created!

Don’t forget your camera when you are out and about! You don’t want to miss what Mother Nature has created!

Wednesday, October 28, 2009

Existing Homes Sales Jump, New Home Sales Drop

Existing home sales surged in September, bringing sales to the highest point since 2007. At the same time, the Department of Commerce just reported that sales of new single family homes fell 3.6% in September to an annual pace of 402,000 units.

Sales of both existing and new homes had been on the rise of late, encouraging many an economist that the worst is behind us. Some will say that the new home sales numbers show that this will be a shakier recovery than in past recessions.

That may be true, but keep in mind that home sales as a whole are up by a pretty large margin. Those sales are helping bring down the inventory of unsold homes, which is so vital to returning to sustainable times.

Analysts had expected new home sales to rise to 440,000 units, most likely based on the final push of first-time buyers looking to take advantage of the $8,000 tax credit that expires at the end of November.

We would expect new homes sales to continue to decline over the next month or two before picking up again. The reason is the expiration of the tax credit.

Buyers looking at new homes will find some homes that are already completed and those that are not yet finished. First-time buyers, which account for nearly 45% of the buyers at the moment, are looking to eliminate any possible risk of missing out on the credit. Purchasing a home still under construction without a guarantee of closing before November 30th will push many would be new home buyers to existing homes.

The numbers may already be bearing this out. In September, sales of existing homes jumped 9.4% to an annual rate of 5.57 million. This is the highest rate in more than two years.

Sales of both existing and new homes had been on the rise of late, encouraging many an economist that the worst is behind us. Some will say that the new home sales numbers show that this will be a shakier recovery than in past recessions.

That may be true, but keep in mind that home sales as a whole are up by a pretty large margin. Those sales are helping bring down the inventory of unsold homes, which is so vital to returning to sustainable times.

Analysts had expected new home sales to rise to 440,000 units, most likely based on the final push of first-time buyers looking to take advantage of the $8,000 tax credit that expires at the end of November.

We would expect new homes sales to continue to decline over the next month or two before picking up again. The reason is the expiration of the tax credit.

Buyers looking at new homes will find some homes that are already completed and those that are not yet finished. First-time buyers, which account for nearly 45% of the buyers at the moment, are looking to eliminate any possible risk of missing out on the credit. Purchasing a home still under construction without a guarantee of closing before November 30th will push many would be new home buyers to existing homes.

The numbers may already be bearing this out. In September, sales of existing homes jumped 9.4% to an annual rate of 5.57 million. This is the highest rate in more than two years.

Monday, October 26, 2009

Congress to Consider Extension of the First-Time Homebuyer Tax Credit

This is a big week for both supporters and detractors of the federal government’s first-time homebuyer tax credit. Key votes will occur over the next couple of days that may decide whether the credit gets extended (and perhaps expanded) beyond its current expiration date, December 1, 2009.

According to the National Association of Realtors, the tax credit will be reason that 350,000 people chose to buy a home this year. This group represents about 6% of all homebuyers in 2009.

This stimulated demand is helping bring down housing inventory, which is one of many factors needed for a recovery. The inventory of unsold homes across the country is now at a 7.8 month supply, which is the lowest level in more than two years. A 6 month supply is considered a balanced market.

However, far more people, nearly 1.8 million, will actually benefit from the first-time homebuyer tax credit. This means that nearly 81% of first-time buyers would have purchased a home even without the credit.

The reason has to do with price. The tax credit, which equates to a more than 4% of the median priced home’s cost, is a nice incentive. However, it is not enough to overcome the cost of buying an overpriced home. Affordability is the real driver of home buying decisions. The median price of a home in the U.S. is now below $178,000, which is 12.5% below year ago levels.

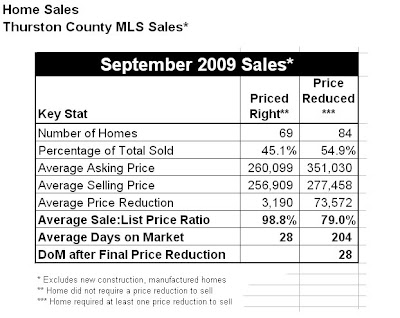

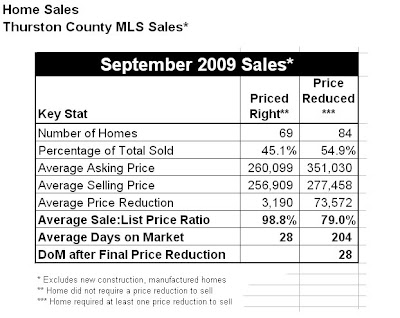

In our local market, overpriced homes are requiring far more than a 4% reduction in price before selling. In September, the overpriced homes required on average a 21% price reduction before selling.

Almost half of the homes are well-priced right now. To buyers of these homes, the tax credit is making a difference. Whether it is making enough of a difference to convince Congressional leaders will be played out this week.

There are two proposals that may be considered this week. This first, offered by Senators Dodd and Isakson, is an extension of the credit through the middle of next year. It would also expand the credit to all buyers of a primary residence. The total cost of this proposal would be $16.7 billion.

The second proposal, offered by Senate Majority Leader Reid, would extend the credit through the end of next year. It would apply only to first-time buyers. The amount would remain at the existing $8,000 (or 10% of the purchase price, whichever is less), but it would phase out $2,000 each quarter throughout 2010. The lower cost of this proposal is one of the reasons it is emerging as the favored proposal.

Regardless of the direction, it should be an interesting week on Capitol Hill.

Click image to enlarge.

Statistics compiled by Coldwell Banker Evergreen Olympic Realty, Inc. from the NWMLS database. Statistics not compiled or published by NWMLS.

According to the National Association of Realtors, the tax credit will be reason that 350,000 people chose to buy a home this year. This group represents about 6% of all homebuyers in 2009.

This stimulated demand is helping bring down housing inventory, which is one of many factors needed for a recovery. The inventory of unsold homes across the country is now at a 7.8 month supply, which is the lowest level in more than two years. A 6 month supply is considered a balanced market.

However, far more people, nearly 1.8 million, will actually benefit from the first-time homebuyer tax credit. This means that nearly 81% of first-time buyers would have purchased a home even without the credit.

The reason has to do with price. The tax credit, which equates to a more than 4% of the median priced home’s cost, is a nice incentive. However, it is not enough to overcome the cost of buying an overpriced home. Affordability is the real driver of home buying decisions. The median price of a home in the U.S. is now below $178,000, which is 12.5% below year ago levels.

In our local market, overpriced homes are requiring far more than a 4% reduction in price before selling. In September, the overpriced homes required on average a 21% price reduction before selling.

Almost half of the homes are well-priced right now. To buyers of these homes, the tax credit is making a difference. Whether it is making enough of a difference to convince Congressional leaders will be played out this week.

There are two proposals that may be considered this week. This first, offered by Senators Dodd and Isakson, is an extension of the credit through the middle of next year. It would also expand the credit to all buyers of a primary residence. The total cost of this proposal would be $16.7 billion.

The second proposal, offered by Senate Majority Leader Reid, would extend the credit through the end of next year. It would apply only to first-time buyers. The amount would remain at the existing $8,000 (or 10% of the purchase price, whichever is less), but it would phase out $2,000 each quarter throughout 2010. The lower cost of this proposal is one of the reasons it is emerging as the favored proposal.

Regardless of the direction, it should be an interesting week on Capitol Hill.

Click image to enlarge.

Statistics compiled by Coldwell Banker Evergreen Olympic Realty, Inc. from the NWMLS database. Statistics not compiled or published by NWMLS.

Friday, October 23, 2009

You're Invited!

Thurston Economic Development Council and the Port of Olympia has announced the NorthPoint Open Houses - You're Invited!

A developer will present its concepts for redevelopment of the NorthPoint District. This waterfront property is located on Marine Drive at the northern tip of the Port Peninsula in downtown Olympia. NorthPoint features spectacular views of Budd Inlet and the Olympic Mountains.

·See proposed development concepts for NorthPoint

·Meet the developer and ask questions

·Provide the Port with your input and comments

TUESDAY October 27, 6:30 p.m. to 8:30 p.m.

The Lacey Community Center

6729 Pacific Avenue SE Olympia, WA 98503

WEDNESDAY October 28, 6:30 p.m. to 8:30 p.m.

The Olympia Center

222 Columbia Street NW Olympia, WA 98501

THURSDAY October 29, 6:30 p.m. to 8:30 p.m.

Tumwater Comfort Inn

1620 74th Avenue SW Tumwater, WA 98501

For More Information Contact:

Heber Kennedy

360.528.8070

http://www.portolympia.com/about/northpoint

A developer will present its concepts for redevelopment of the NorthPoint District. This waterfront property is located on Marine Drive at the northern tip of the Port Peninsula in downtown Olympia. NorthPoint features spectacular views of Budd Inlet and the Olympic Mountains.

·See proposed development concepts for NorthPoint

·Meet the developer and ask questions

·Provide the Port with your input and comments

TUESDAY October 27, 6:30 p.m. to 8:30 p.m.

The Lacey Community Center

6729 Pacific Avenue SE Olympia, WA 98503

WEDNESDAY October 28, 6:30 p.m. to 8:30 p.m.

The Olympia Center

222 Columbia Street NW Olympia, WA 98501

THURSDAY October 29, 6:30 p.m. to 8:30 p.m.

Tumwater Comfort Inn

1620 74th Avenue SW Tumwater, WA 98501

For More Information Contact:

Heber Kennedy

360.528.8070

http://www.portolympia.com/about/northpoint

Monday, October 19, 2009

Family Fun, Pumpkin Patches & More

Looking for a family friendly place to take the kids this Halloween season? Well, look no further. Here is your list of Olympia’s pumpkin patches, haunted happenings and fun Halloween night time activities. Pick out the perfect pumpkin, race through the corn maze, pick up your fresh produce and feed the friendly farm animals.

Don’t forget to wear your scariest costume Halloween night! There are plenty of safe and fun places to pick from for your Trick-or-Treating entertainment. Want to be scared? We have the list for frightening Haunted Houses and Mazes that will have you shaking in your boots.

Don’t forget to wear your scariest costume Halloween night! There are plenty of safe and fun places to pick from for your Trick-or-Treating entertainment. Want to be scared? We have the list for frightening Haunted Houses and Mazes that will have you shaking in your boots.

Happy Haunting everyone! Be safe and have FUN!

Hunters Pumpkin Patch -

Lattin’s Country Cider Mill & Farm -

Rutledge Corn Maze -

Schilter Family Farm –

http://www.everydayolympia.com/halloween/

“The Thurston County Scare” at Thurston County Fair Grounds - http://www.co.thurston.wa.us/fair/tc-scare-info.htm

“Howl-O-Ween” at Wolf Haven –

http://www.wolfhaven.org/howlOween.php

“Halloween Family Fun Night” at Westfield Capitol Mall - http://westfield.com/capital/specialoffers/HalloweenFamilyFunatWestfieldCapital.html

“Halloween Extravaganza” at Briggs Community YMCA - http://www.southsoundymca.org/pages/get-involved/events-calendar.php?searchresult=1&sstring=Briggs+Halloween+Extravaganza

Halloween safety website -

http://www.halloween-safety.com/“The Thurston County Scare” at Thurston County Fair Grounds - http://www.co.thurston.wa.us/fair/tc-scare-info.htm

“Howl-O-Ween” at Wolf Haven –

http://www.wolfhaven.org/howlOween.php

“Halloween Family Fun Night” at Westfield Capitol Mall - http://westfield.com/capital/specialoffers/HalloweenFamilyFunatWestfieldCapital.html

“Halloween Extravaganza” at Briggs Community YMCA - http://www.southsoundymca.org/pages/get-involved/events-calendar.php?searchresult=1&sstring=Briggs+Halloween+Extravaganza

Halloween safety website -

Monday, October 12, 2009

Group to Recognize Philanthropic Leaders in our Community

An active and generous philanthropic population is one of the many things that make our community such an outstanding place to call home.

One unique thing about our community is a cooperative association of many of the local non-profits that put the donated time, treasure and talents to good work.

The South Sound Partners for Philanthropy is a consortium of 34 local non-profits whose mission is to raise awareness for philanthropy in our community.

In these economic times when charitable giving is so desperately needed, it is great to see this group working together to help the cause. It is a competitive thing going after charitable dollars and donated time, so it is nice to see a group that works to advance the cause of philanthropy in general. This group clearly knows that a rising tide lifts all boats. We appreciate your efforts.

One way the group promotes giving back is by recognizing those who give. Every year the group comes together for the Leadership in Philanthropy Awards, which will be held early next month. The awards honor groups and individuals who demonstrate outstanding philanthropic efforts in our community.

We want to also acknowledge the outstanding community citizens who are being recognized at this year’s awards ceremony. Their work inspires us to keep up our own philanthropic endeavors. This year’s recipients are:

Berschauer Phillips Construction Company (Business of the Year - Large);

McKinney’s Appliance, Inc. (Business of the Year – Small);

Zonta Club of Olympia (Philanthropic Group of the Year);

Kimberly and Charles Ellwanger (Individual/Couple of the Year);

Kim Vivian (Young Philanthropist); and

Tom and Elsa McLain (Inspirational Award).

Thank you, award recipients, for your great work. As a past recipient of Business of the Year, we know what an honor it is to be recognized. We also know that it is not the accolades that these people seek but just the feeling of making a positive contribution to this great community. Congratulations!

For more information about the South Sound Partners for Philanthropy visit http://www.celebrategiving.org/.

One unique thing about our community is a cooperative association of many of the local non-profits that put the donated time, treasure and talents to good work.

The South Sound Partners for Philanthropy is a consortium of 34 local non-profits whose mission is to raise awareness for philanthropy in our community.

In these economic times when charitable giving is so desperately needed, it is great to see this group working together to help the cause. It is a competitive thing going after charitable dollars and donated time, so it is nice to see a group that works to advance the cause of philanthropy in general. This group clearly knows that a rising tide lifts all boats. We appreciate your efforts.

One way the group promotes giving back is by recognizing those who give. Every year the group comes together for the Leadership in Philanthropy Awards, which will be held early next month. The awards honor groups and individuals who demonstrate outstanding philanthropic efforts in our community.

We want to also acknowledge the outstanding community citizens who are being recognized at this year’s awards ceremony. Their work inspires us to keep up our own philanthropic endeavors. This year’s recipients are:

Berschauer Phillips Construction Company (Business of the Year - Large);

McKinney’s Appliance, Inc. (Business of the Year – Small);

Zonta Club of Olympia (Philanthropic Group of the Year);

Kimberly and Charles Ellwanger (Individual/Couple of the Year);

Kim Vivian (Young Philanthropist); and

Tom and Elsa McLain (Inspirational Award).

Thank you, award recipients, for your great work. As a past recipient of Business of the Year, we know what an honor it is to be recognized. We also know that it is not the accolades that these people seek but just the feeling of making a positive contribution to this great community. Congratulations!

For more information about the South Sound Partners for Philanthropy visit http://www.celebrategiving.org/.

Friday, October 9, 2009

The Real Impact of Pricing Right

In this housing market not many positive records are being set. One notable exception comes as a great surprise to the casual market observer – length of time on the market. In this down market, well priced homes are selling in record time.

And time, as the old saying goes, is money.

With the torrent of down news about the housing market over the past couple of years, most people would expect that all homes are languishing on the market, just praying for a buyer to appear.

The market as a whole is certainly moving much slower than it did a few years back. The average market time for existing home sales now stands at 125 days, which is nearly two months longer than at the peak of the market in 2006.

But that picture alone is a bit deceiving. A more detailed look at today’s market reveals quite a different picture.

When we separate September 2009 homes sales into categories of those that required a price reduction before selling (overpriced listings) and those that did not (well priced listings), we find that the well priced listings are selling in just 28 days. This is 17 days faster than well priced homes sold in the summer of 2006, the peak of the recent boom market.

If you regularly follow our blog, you know that well priced homes have been selling at this pace for most of the year. Today’s buyers realize that these well priced homes are at levels of affordability that haven’t existed for some time. They are jumping to take advantage of both the lower prices and very low interest rates.

A different story emerges for the overpriced listings. They averaged 204 days on market. After six months on market, these homes are requiring an average price reduction of 21%. They are then selling in an average just 28 days once they get to the correct price.

That extra six months on market hurts in a couple of ways. First, these homes end up selling for less than they could have if they had just started off priced right. Our market, like all others around the country has seen declining prices over the past two years. Since the peak in prices in 2007 the average sales price has dropped about one-half a percent per month. That means the six months of extra market time cost the seller an additional 3%. This amounts to $7,938 for the average priced home ($264,600).

The second concern is the extra months of mortgage payments. The typical seller only receives a financial benefit on about half of the mortgage payment. The other half is lost. And the amount is significant.

The average time in a home before selling is six years. In the sixth year of a 30-year fixed rate mortgage at 5.5% interest, only 26% of the payment goes toward principal. The tax write off of the interest portion of the payments (for a tax payer in the 28% bracket) brings that benefit up to 47% of the mortgage payment. That means that 53% of the mortgage payment does not bring any financial benefit to the seller. On the average priced home, this costs the seller an additional $8,000.

So the financial impact of pricing the home right is significant. The emotional impact is also huge. Six additional months of keeping the home in show condition, of the feeling of being in limbo, and missing the chance to move to that next home that better suits the seller’s current needs are also a big part of the equation.

More and more sellers are beginning to understand these factors. Last month, 45% of sellers priced their homes right and sold in an average of just 28 days. Still not a majority of sellers, but the percentage is up significantly since the start of the year. In January, only 29% of sellers priced right from the start.

The overpriced sellers should not beat themselves up too much. In a changing market, it is sometimes hard to know what the right price is. Sometimes it takes entering the market to get feedback from buyers to know if the price is right. The key to finding the right price in those instances is to quickly review the market feedback and then make a swift price adjustment to bring it in line with the market. When done, our market’s steady activity tells us these sellers will find a ready and willing buyer.

Click image to enlarge.

Statistics compiled by Coldwell Banker Evergreen Olympic Realty, Inc. from the NWMLS database. Statistics not compiled or published by NWMLS.

And time, as the old saying goes, is money.

With the torrent of down news about the housing market over the past couple of years, most people would expect that all homes are languishing on the market, just praying for a buyer to appear.

The market as a whole is certainly moving much slower than it did a few years back. The average market time for existing home sales now stands at 125 days, which is nearly two months longer than at the peak of the market in 2006.

But that picture alone is a bit deceiving. A more detailed look at today’s market reveals quite a different picture.

When we separate September 2009 homes sales into categories of those that required a price reduction before selling (overpriced listings) and those that did not (well priced listings), we find that the well priced listings are selling in just 28 days. This is 17 days faster than well priced homes sold in the summer of 2006, the peak of the recent boom market.

If you regularly follow our blog, you know that well priced homes have been selling at this pace for most of the year. Today’s buyers realize that these well priced homes are at levels of affordability that haven’t existed for some time. They are jumping to take advantage of both the lower prices and very low interest rates.

A different story emerges for the overpriced listings. They averaged 204 days on market. After six months on market, these homes are requiring an average price reduction of 21%. They are then selling in an average just 28 days once they get to the correct price.

That extra six months on market hurts in a couple of ways. First, these homes end up selling for less than they could have if they had just started off priced right. Our market, like all others around the country has seen declining prices over the past two years. Since the peak in prices in 2007 the average sales price has dropped about one-half a percent per month. That means the six months of extra market time cost the seller an additional 3%. This amounts to $7,938 for the average priced home ($264,600).

The second concern is the extra months of mortgage payments. The typical seller only receives a financial benefit on about half of the mortgage payment. The other half is lost. And the amount is significant.

The average time in a home before selling is six years. In the sixth year of a 30-year fixed rate mortgage at 5.5% interest, only 26% of the payment goes toward principal. The tax write off of the interest portion of the payments (for a tax payer in the 28% bracket) brings that benefit up to 47% of the mortgage payment. That means that 53% of the mortgage payment does not bring any financial benefit to the seller. On the average priced home, this costs the seller an additional $8,000.

So the financial impact of pricing the home right is significant. The emotional impact is also huge. Six additional months of keeping the home in show condition, of the feeling of being in limbo, and missing the chance to move to that next home that better suits the seller’s current needs are also a big part of the equation.

More and more sellers are beginning to understand these factors. Last month, 45% of sellers priced their homes right and sold in an average of just 28 days. Still not a majority of sellers, but the percentage is up significantly since the start of the year. In January, only 29% of sellers priced right from the start.

The overpriced sellers should not beat themselves up too much. In a changing market, it is sometimes hard to know what the right price is. Sometimes it takes entering the market to get feedback from buyers to know if the price is right. The key to finding the right price in those instances is to quickly review the market feedback and then make a swift price adjustment to bring it in line with the market. When done, our market’s steady activity tells us these sellers will find a ready and willing buyer.

Click image to enlarge.

Statistics compiled by Coldwell Banker Evergreen Olympic Realty, Inc. from the NWMLS database. Statistics not compiled or published by NWMLS.

Thursday, October 8, 2009

Mortgage Rates: How Low Can They Go?

Mortgage rates dropped again this past week, according to Freddie Mac’s Weekly Primary Mortgage Market Survey. The average rate on a 30-year fixed rate mortgage now stands at 4.87% with average points and fees of 0.7, down from 4.94% the week before.

These are the lowest the rates have been since mid-May, and very near the all-time low of 4.78% established in April 2009.

Rates on the 15-year fixed rate mortgage averaged 4.33%, with average points and fees of 0.7. This is the lowest the 15-year rate has been since Freddie Mac began tracking the data in 1991.

See our post on October 2nd, entitled Lower Interest Rates Keep More Money in Borrowers Pockets, for more about these lower rates and refinancing an existing loan.

These are the lowest the rates have been since mid-May, and very near the all-time low of 4.78% established in April 2009.

Rates on the 15-year fixed rate mortgage averaged 4.33%, with average points and fees of 0.7. This is the lowest the 15-year rate has been since Freddie Mac began tracking the data in 1991.

See our post on October 2nd, entitled Lower Interest Rates Keep More Money in Borrowers Pockets, for more about these lower rates and refinancing an existing loan.

Monday, October 5, 2009

Pending Home Sales Jump Again, Closed Sales Holding Steady

In September, Thurston County’s pending home sales climbed 14.5% over year ago results. There were 380 pending sales in September 2009 versus 332 in September 2008. A pending sale is a contract that is accepted but has not yet closed.

September’s performance brings the string of positive gains in pending sales to five months. For the year, pending sales are up 5.7% over 2008.

There are several factors leading to the increase: (1) interest rates, (2) the first-time home buyer tax credit, and (3) lower home prices.

As we reported last week, interest rates are approaching their record lows set earlier this year. Those rates are driving down the cost of ownership and buyers are recognizing the opportunity.

The first-time home buyer tax credit is also spurring activity amongst that set of buyers. The looming expiration of the credit (must close by November 30, 2009) is urging these buyers to act quickly. By some estimates, nearly 1.8 million home buyers will qualify for the tax credit.

Of all the positive forces in the market, however, none is bigger than price. Where a home is well-priced, we are seeing it move in record time. When the home is not well-priced it languishes on the market for months longer. Even then, it sells only after reducing to the right price. See our post later this week entitled The Real Impact of Pricing Right.

The median sales price for a Thurston County home is $242,900 this year, down 5.5% from 2008. Median sales price is down 11.5% across the 19-county area, which includes most of Western Washington, covered by the Northwest Multiple Listing Service.

As a signal that fewer pending sales become closed sales is the fact that closed sales are down 11.4% this year. The greatest obstacle to closing pending sales comes from the bank-owned and short sale properties, which accounted for 26% of our market’s sales in August. Lenders on short sales are taking anywhere from two to four months to make a decision on approving or denying the sale. It would seem that more are denied than approved given that there were only 13 short sales in August compared to 44 bank-owned homes sold.

Despite the challenges with bank-owned and short sale properties, momentum is picking up in the market. Closed sales over the past few months more closely match the 2008 results. September closed sales totaled 260, just 4 sales fewer than September 2008.

The pace of sales is slowly but steadily absorbing the excess inventory of homes on the market. We are now at 6.7 months supply of homes for sale, which is still a buyer’s market but the lowest since this time last year. The return to better balance will bring back longer-term sustainability in our market.

September’s performance brings the string of positive gains in pending sales to five months. For the year, pending sales are up 5.7% over 2008.

There are several factors leading to the increase: (1) interest rates, (2) the first-time home buyer tax credit, and (3) lower home prices.

As we reported last week, interest rates are approaching their record lows set earlier this year. Those rates are driving down the cost of ownership and buyers are recognizing the opportunity.

The first-time home buyer tax credit is also spurring activity amongst that set of buyers. The looming expiration of the credit (must close by November 30, 2009) is urging these buyers to act quickly. By some estimates, nearly 1.8 million home buyers will qualify for the tax credit.

Of all the positive forces in the market, however, none is bigger than price. Where a home is well-priced, we are seeing it move in record time. When the home is not well-priced it languishes on the market for months longer. Even then, it sells only after reducing to the right price. See our post later this week entitled The Real Impact of Pricing Right.

The median sales price for a Thurston County home is $242,900 this year, down 5.5% from 2008. Median sales price is down 11.5% across the 19-county area, which includes most of Western Washington, covered by the Northwest Multiple Listing Service.

As a signal that fewer pending sales become closed sales is the fact that closed sales are down 11.4% this year. The greatest obstacle to closing pending sales comes from the bank-owned and short sale properties, which accounted for 26% of our market’s sales in August. Lenders on short sales are taking anywhere from two to four months to make a decision on approving or denying the sale. It would seem that more are denied than approved given that there were only 13 short sales in August compared to 44 bank-owned homes sold.

Despite the challenges with bank-owned and short sale properties, momentum is picking up in the market. Closed sales over the past few months more closely match the 2008 results. September closed sales totaled 260, just 4 sales fewer than September 2008.

The pace of sales is slowly but steadily absorbing the excess inventory of homes on the market. We are now at 6.7 months supply of homes for sale, which is still a buyer’s market but the lowest since this time last year. The return to better balance will bring back longer-term sustainability in our market.

Friday, October 2, 2009

Lower Interest Rates Keep More Money in Borrowers Pockets

The average rate on a 30-year fixed rate mortgage dropped below 5% for the first time since May 2009. Since reaching 5.59% in mid-June, rates have fallen by 0.65% to land this week at 4.94%. (See related post on October 1, 2009).

That drop means real savings for homebuyers. For example, someone borrowing $300,000 would save $1,450 per year with an interest rate of 4.94% versus 5.59%. That savings equates to nearly one full mortgage payment (principal and interest).

At 5.59% the monthly principal and interest payment on the $300,000 loan would be $1,720. At the 4.94% rate, the monthly payment would be just $1,599.

If you are considering a refinance of an existing loan, there is more to think about than just the monthly savings. Balanced against the lower monthly payment is the cost the lender charges for the refinance loan.

The cost of the loan should then be compared to the monthly savings along with the length of time you plan to stay in your home. If you plan to stay long enough for the monthly savings to outweigh the upfront costs, then the refinance might make sense. If you plan to move soon, the costs may greatly outweigh the savings.

That drop means real savings for homebuyers. For example, someone borrowing $300,000 would save $1,450 per year with an interest rate of 4.94% versus 5.59%. That savings equates to nearly one full mortgage payment (principal and interest).

At 5.59% the monthly principal and interest payment on the $300,000 loan would be $1,720. At the 4.94% rate, the monthly payment would be just $1,599.

If you are considering a refinance of an existing loan, there is more to think about than just the monthly savings. Balanced against the lower monthly payment is the cost the lender charges for the refinance loan.

The cost of the loan should then be compared to the monthly savings along with the length of time you plan to stay in your home. If you plan to stay long enough for the monthly savings to outweigh the upfront costs, then the refinance might make sense. If you plan to move soon, the costs may greatly outweigh the savings.

Thursday, October 1, 2009

Interest Rates take another drop, approaching record lows

The average rate on a 30-year fixed rate loan dipped back near all-time lows again this week, according to Freddie Mac’s Weekly Primary Mortgage Market Survey (PMMS) for the week ending October 1, 2009.

The average rate now stands at 4.94%. That is the lowest level since May 28th, and approaching the record low set on April 30, 2009. A year ago the average rate stood at 6.10%.

It is important to remember that these rates are just averages. Actual rates will vary for each home borrower depending on loan type, size of down payment, and the borrower’s credit score, among other things.

Besides the interest rate, a borrower should keep an eye out for the fees and points that a lender is charging for the loan. Along with interest rate, those fees and points combine to make up the actual cost of the loan reflected in the Annual Percentage Rate or APR.

According to the PMMS, the average fees and points charged on the 30-year fixed rate loan is holding steady at 0.7, which is where it has been for most of the year.

Visit http://www.freddiemac.com/pmms/ for additional information on the history of mortgage rates.

The average rate now stands at 4.94%. That is the lowest level since May 28th, and approaching the record low set on April 30, 2009. A year ago the average rate stood at 6.10%.

It is important to remember that these rates are just averages. Actual rates will vary for each home borrower depending on loan type, size of down payment, and the borrower’s credit score, among other things.

Besides the interest rate, a borrower should keep an eye out for the fees and points that a lender is charging for the loan. Along with interest rate, those fees and points combine to make up the actual cost of the loan reflected in the Annual Percentage Rate or APR.

According to the PMMS, the average fees and points charged on the 30-year fixed rate loan is holding steady at 0.7, which is where it has been for most of the year.

Visit http://www.freddiemac.com/pmms/ for additional information on the history of mortgage rates.

Subscribe to:

Posts (Atom)