Tuesday, December 29, 2009

Polar Bear Plunge, Olympia 2010

The event starts at noon at Long Lake Park, all ages are welcome. 2790 Carpenter Rd SE, Lacey, WA. For more information contact Lacey Parks and Recreation at (360) 491-0857 or http://www.ci.lacey.wa.us/

Wednesday, December 23, 2009

Happy Holidays From Coldwell Banker

Tuesday, December 15, 2009

Fantasy Lights in Spanaway Park

Fantasy Lights will be open every night including Christmas and New Year's Eve from 5:30 pm - 9:00 pm.

Directions to FANTASY LIGHTS at Spanaway Park:

- From I-5 take Exit 127 (Puyallup/Mt. Rainier)

- Head east on Hwy 512

- Take the second exit (Parkland/Spanaway)

- At stop light, turn right onto Pacific Avenue (SR 7)

- Go south for 2.7 miles

- Turn right onto Military Road (152nd St).

- Spanaway Park entrance is a 1/2 mile on the left.

For more information visit http://www.co.pierce.wa.us/PC/abtus/ourorg/parks/flights.htm

Wednesday, December 9, 2009

Zoo Lights at Point Defiance

Grab your mittens, your warm winter jacket and head to Point Defiance Zoo as it lights up with more than a half-million lights. Zoo Lights is a wonderful place to enjoy the beauty of the holiday season! Only here through January 3, 2010 so hurry up and don't miss out on the fun!

Grab your mittens, your warm winter jacket and head to Point Defiance Zoo as it lights up with more than a half-million lights. Zoo Lights is a wonderful place to enjoy the beauty of the holiday season! Only here through January 3, 2010 so hurry up and don't miss out on the fun!http://www.pdza.org/page.php?id=435

Thursday, December 3, 2009

Thurston County Home Sales Record Biggest Jump of the Year

The looming deadline for the $8,000 first-time homebuyer tax credit surely had an impact in the size of the jump. The credit was set to expire November 30, 2009. The President signed an extension of the credit on November 6th. The credit will now be available on homes under contract by April 30, 2010.

Affordability has also been a driver in home sales. Average prices countywide are down about 8% since this time last year and down 12.4% since the peak in 2007. Those lower prices combined with mortgage rates below 5% have created some of the most affordable conditions on record.

Freddie Mac reported just today that interest rates on a 30 year, fixed rate mortgage are at the lowest level on record. In its weekly mortgage market survey for the week ending December 3rd, the company reports those rates averaged just 4.71%. The previous record low was 4.78%, set in April of this year. Freddie Mac has been tracking these rates since 1971.

These affordability conditions coupled with the recent expansion of the tax credit to cover certain repeat buyers should continue to propel sales through the winter months. The momentum has already started. Pending home sales, which are those under contract but not yet closed, just logged their seventh straight month of besting 2008 levels. In November, pending sales were up a healthy 7.5% over last year.

Wednesday, December 2, 2009

Olympia Yacht Club's Lighted Ships Parade

The parade will begin at 6 p.m. tonight at Percival Landing in downtown Olympia, follow along the eastern shore of Budd Inlet to Boston Harbor and will return along the western shore of Budd Inlet to Percival Landing. Don't miss the second Lighted Ships Parade this Saturday December 5th!

Also, the Olympia Yacht Club, in partnership with Thurston County Parks and Recreation, Olympia Harbor Patrol and Seattle Seafair, will host some 135 persons with physical and developmental disabilities on a Special Peoples Cruise in Budd Inlet at 1 p.m. Sunday.

Bundle up, head downtown and enjoy the beautiful Lighted Ships Parade!

http://www.olympiayachtclub.org/

Wednesday, November 25, 2009

Happy Thanksgiving from Coldwell Banker!

Though many different stories exist, the most familiar is the story of the first Thanksgiving that took place in Plymouth Colony, in present-day Massachusetts, in 1621. More than 200 years later, President Abraham Lincoln declared the final Thursday in November as a national day of thanksgiving. Congress finally made Thanksgiving Day an official national holiday in 1941.

Though many different stories exist, the most familiar is the story of the first Thanksgiving that took place in Plymouth Colony, in present-day Massachusetts, in 1621. More than 200 years later, President Abraham Lincoln declared the final Thursday in November as a national day of thanksgiving. Congress finally made Thanksgiving Day an official national holiday in 1941.Providence St. Peter Foundation’s Christmas Forest

Come check out Coldwell Banker's "Sweet Dreams" Christmas Tree at the 22nd annual Christmas Forest opening on Thanksgiving Day! This traditional fund raising event benefits the Providence mission to provide basic health services to those in need.

All events will be held at the Red Lion Olympia Hotel, 2300 Evergreen Park Drive.

Monday, November 23, 2009

Existing U.S. Homes Sales Hit Record Percentage Growth

The NAR credits the jump to many buyers rushing to beat the tax credit deadline. That first-time homebuyer tax credit was set to expire on November 30, 2009. The President just signed an extension and expansion of the credit earlier this month.

The biggest factor in the jump in demand may be price. Home prices across the country continued to correct in October, although at a slower pace than seen. The median existing home price was down 7.1% from October 2008 to settle at 173,100. Those prices have “affordability conditions this year at the highest on record, dating back to 1970,” according to NAR Chief Economist Lawrence Yun.

While most of the northwest is still not matching the positive gains seen in the rest of the nation, prices here are beginning to compel buyers in all price segments to act. (See our September 10, 2009 post entitled Washington vs. the U.S., where we examine why our market’s news will not match the national picture.)

Locally, home sales are still below year ago levels, but the gap is closing. In October, there were 280 home sales compared to 297 in October 2008. Through the first three quarters of the year, sales are off 10.7% compared to the same period last year. This is a big improvement since the start of the year when sales year off 21.5% through the first quarter.

Local pending home sales, those under contract but not yet closed, have bested 2008 numbers for six straight months. The reason for the gap between pending and closed sales has to do with bank approval of short sales. Most short sales are still not approved by the banks causing many contracts to fall apart before closing.

Even with fewer closed sales, our market’s supply demand balance is better than the rest of the nation. Locally, we have a 6.5 month supply of homes for sale, which is down from its peak of 8 months earlier this year.

Despite the good news nationally, supply is still higher than Thurston County. However, at just a 7 month supply, inventory is the lowest it has been since early 2007. There was nearly an 11.5 month supply at the beginning of 2008.

Click image to enlarge.

Click image to enlarge.

Both the local and national numbers are trending back toward a balanced market, which will be achieved at a six month supply. Given the local market factors, we expect median prices in our market to continue correct marginally through the spring of 2010 and then begin a steady but slow recovery.

Buyers are out there ready to act, armed with an expanded home buyer credit and interest rates that are the third lowest on records dating back to the early 1970s. When they see well priced homes today, they are acting quickly. As more sellers price to today’s market conditions, we will see inventory come into balance and the market return to our more sustainable patterns of growth.

Statistics compiled by Coldwell Banker Evergreen Olympic Realty, Inc. from the NWMLS database. Statistics not compiled or published by NWMLS.Wednesday, November 18, 2009

Thurston County Food Bank

Join Coldwell Banker this holiday season in helping the Thurston County Food Bank serve our community! Many families in our area are struggling to provide basic needs for their households. In 2008, the TCFB served a record 37,000 clients, a 39% increase from 2007. Remember that every can counts and will give hope to all who will receive these generous donations from people like you.

Join Coldwell Banker this holiday season in helping the Thurston County Food Bank serve our community! Many families in our area are struggling to provide basic needs for their households. In 2008, the TCFB served a record 37,000 clients, a 39% increase from 2007. Remember that every can counts and will give hope to all who will receive these generous donations from people like you.

Wednesday, November 11, 2009

Coldwell Banker Thanks Our Veterans

In 1954, after World War II and the Korean War, the 83rd U.S. Congress amended the Act of 1938 by striking out the word “Armistice” and inserting the word “Veterans”.

United States Senate Resolution 143, which was passed on August 4, 2001, designated the week of November 11 through November 17, 2001, as “National Veterans Awareness Week”. The resolution calls for education efforts directed at elementary and secondary school students concerning the contribution and sacrifices of veterans.

We thank you for your service to our country and remember the sacrifices of our American veterans.

Below is a link to a few Veterans Day Discounts

http://www.military.com/veterans-day/veterans-day-discounts.html

Veterans Appreciation Dinner 2009

Sunday, Nov 15 5:00 pm

St. Martin’s Marcus Pavilion, Lacey, WA

Reserve your place at this year's Veterans Appreciation Dinner. This special evening is designed to honor the men and women of all military conflicts. This is an opportunity to pay tribute to our veterans, to thank them for the bravery and for their sacrifices they made to defend our freedom and the American way of life. read more

Price: $25 per person

Phone: 360-438-0114 or 360-491-4959

5300 Pacific Ave S.E., Lacey, WA, 98503

2009 Veterans Day Events & Observations for Washington State

November 7-11, 2009

Friday, November 6, 2009

Homebuyer Tax Credit Extended and Expanded

The provisions of this new law apply to any purchases made as of today’s date. This means that any first-time buyer who couldn’t close before December 1, 2009 (the original expiration date) now need not worry about losing out on the credit. It also means that the newly qualifying repeat buyers will receive the credit on any qualified closing starting today.

Some key provisions of the new tax credit include:

- An extension of the credit to cover any purchase of a principal residence by qualifying buyers who are under contract by April 30, 2010 and close by June 30, 2010.

- An expansion of coverage in two ways:

1. Broadens those eligible to more than first-time buyers.

“LONG-TIME RESIDENTS OF SAME PRINCIPAL RESIDENCE” now qualify. These are buyers who have “owned and used the same residence as such individual's principal residence for any 5-consecutive-year period during the 8-year period ending on the date of the purchase of a subsequent principal residence.” Quoting from H.R. 3548 as passed by the House and Senate.

- The credit amount for these buyers is 10% of the purchase price to a maximum of $6,500. Any qualifying buyer purchasing a home costing more than $65,000 will receive the full amount (See the purchase price limitation below).

- The credit still applies to first-time buyers (which includes anyone who has not owned a home for the past three years). The credit amount for these buyers remains at 10% of the purchase price to a maximum of $8,000. Any qualifying buyer purchasing a home costing more than $80,000 will receive the full amount (See the purchase price limitation below).

2. Raises the income limits.

- The full credit amounts are available to single persons who earn $125,000

($225,000 for married couples) or less. The previous limits were $75,000

(singles) and $150,000 (married couples).- A reduced credit is available for incomes above those amounts, with no credit available above $145,000 for singles, and $245,000 for married couples.

- A new limitation in the form of a cap on the purchase price. No credit will be available to an otherwise qualifying buyer who purchases a home costing more than $800,000.

- A new anti-fraud provision, which requires that the buyer claiming the credit to attach to the tax return a properly executed copy of the settlement statement used to complete the purchase.

If you are planning to take advantage of the tax credit, be sure to check with your accountant or tax attorney for all of the details. The IRS website will also have some additional information on the new provisions. Visit http://www.irs.gov/ to learn more.

Thursday, November 5, 2009

Pending Home Sales Up Again

October is the sixth straight month of year over year gains. This string in sales is mostly a result of lower prices. The median price of homes sold this year is now $240,000, which is down 6.6% from last year.

The median sales price in October was much lower, at just $229,450. This reflects the push by first-time buyers, who are mainly in the lower price points, to beat the clock on the $8,000 tax credit that was set to expire on December 1, 2009.

Congress has now voted to extend the tax credit and the President will sign it into law tomorrow. (See our related posts for more on the new tax credit.)

Despite the gains in pending sales, which are contracts accepted but not yet completed, closed sales dropped 5.7% in October 2009 versus October 2008. As we’ve reported in the past months, the gap between better pending sales and closed sales continues to be the short sale properties. Many of those sales are not being approved by the banks. (See our October 5, 2009 post Pending Home Sales Jump Again, Closed Sales Holding.)

The greatest level of activity is at the low end of the market. In October 60% of sales were under $250,000. By comparison, only 6% of all sales were above $400,000.

The tax credit has been credited with jump starting the low end of the market. That theory might be a bit misplaced. The National Association of Realtors estimates that approximately 350,000 people were encouraged to buy due to the tax credit. That is only about 6% of all homebuyers this year. Nearly 1.8 million people will receive the tax credit in 2009. Most people are buying for other reasons.

The tax credit is certainly giving incentive to shop. Shoppers are becoming buyers only when the price is right. Most of the price reduction activity has been at the low end of the market where bank owned and short sale properties account for nearly 50% of the sales.

The tax credit that is being signed tomorrow expands coverage beyond first-time buyers. Certain repeat buyers will receive a $6,500 tax credit. The sellers in the higher price ranges may find more shoppers as a result of this expansion of the credit. If their prices are right, those shoppers will definitely become buyers.

Tax Credit Will Be Signed Into Law Tomorrow

Wednesday, November 4, 2009

Senate Votes to Extend and Expand Tax Credit

The House of Representatives will act on the measure tomorrow. We will provide the details when the credit is signed into law, which could happen as early as Friday. In the meantime, check our posts from earlier this week and last for more information on the credit.

Tuesday, November 3, 2009

Tax Credit Headed for Extension (and Expansion)

The program was set to expire December 1, 2009. The extension will keep the credit in place through next spring. When enacted, the tax credit will be available for primary residence purchases that are under contract by April 30, 2010 and close by June 30, 2010.

The original tax credit was aimed at just first-time home buyers, and offered them a credit of 10% of the purchase price to a maximum of $8,000. The version of the credit making its way through Congress now keeps that credit in place, but it will now cover some repeat buyers as well.

The new tax credit will be available to buyers who have owned a primary residence for five consecutive years out of the last eight. The credit amount will be $6,500.

Qualifying income limits for both the first-time buyer credit and the repeat buyer will be raised to $150,000 for single tax filers and $225,000 for joint filers. That will cover a lot of buyers in our region.

We will keep you posted on the progress as the extension and expansion of the program makes it through Congress.

Friday, October 30, 2009

Buyer's Guide Featured Articles

The current $8,000 tax credit for first-time homebuyers expires at the end of November. Read more on our October posting entitled

"Tax Credit Extension Moves One Step Closer"

Existing Home Sales Surged in September

Existing home sales jumped 9.4% in September to an annual rate of 5.57 million homes, which is the highest rate in more than two years. Read more on our October posting entitled

"Existing Home Sales Jump, New Home Sales Drop"

Thursday, October 29, 2009

Tax Credit Extension Moves One Step Closer

Enactment of the extension is still quite a ways off, but the Senate has reportedly reached a compromise on what the tax credit provision would look like going forward.

The first-time buyer credit of up to $8,000 (or 10% of the purchase price, whichever is less) would be extended until April 30, 2010.

The program is also slated for expansion. If passed it would provide a benefit to people who have owned and lived in a primary residence for five consecutive years out of the past eight. These buyers would have a $6,500 tax credit.

A lot of political maneuvering must still occur before this is a done deal. Senate leaders want to attach the tax credit provision to a bill that would extend unemployment benefits.

If the Senate does act favorably, the House must take action. So stay tuned. We will keep you updated as this moves its way through Congress.

Olympia in the Fall

The ground is covered with a layer of wet yellow leaves and it is spectacular. Bright colors, crisp clean air, foggy mornings, Olympia is a great place to live!

Don’t forget your camera when you are out and about! You don’t want to miss what Mother Nature has created!

Wednesday, October 28, 2009

Existing Homes Sales Jump, New Home Sales Drop

Sales of both existing and new homes had been on the rise of late, encouraging many an economist that the worst is behind us. Some will say that the new home sales numbers show that this will be a shakier recovery than in past recessions.

That may be true, but keep in mind that home sales as a whole are up by a pretty large margin. Those sales are helping bring down the inventory of unsold homes, which is so vital to returning to sustainable times.

Analysts had expected new home sales to rise to 440,000 units, most likely based on the final push of first-time buyers looking to take advantage of the $8,000 tax credit that expires at the end of November.

We would expect new homes sales to continue to decline over the next month or two before picking up again. The reason is the expiration of the tax credit.

Buyers looking at new homes will find some homes that are already completed and those that are not yet finished. First-time buyers, which account for nearly 45% of the buyers at the moment, are looking to eliminate any possible risk of missing out on the credit. Purchasing a home still under construction without a guarantee of closing before November 30th will push many would be new home buyers to existing homes.

The numbers may already be bearing this out. In September, sales of existing homes jumped 9.4% to an annual rate of 5.57 million. This is the highest rate in more than two years.

Monday, October 26, 2009

Congress to Consider Extension of the First-Time Homebuyer Tax Credit

According to the National Association of Realtors, the tax credit will be reason that 350,000 people chose to buy a home this year. This group represents about 6% of all homebuyers in 2009.

This stimulated demand is helping bring down housing inventory, which is one of many factors needed for a recovery. The inventory of unsold homes across the country is now at a 7.8 month supply, which is the lowest level in more than two years. A 6 month supply is considered a balanced market.

However, far more people, nearly 1.8 million, will actually benefit from the first-time homebuyer tax credit. This means that nearly 81% of first-time buyers would have purchased a home even without the credit.

The reason has to do with price. The tax credit, which equates to a more than 4% of the median priced home’s cost, is a nice incentive. However, it is not enough to overcome the cost of buying an overpriced home. Affordability is the real driver of home buying decisions. The median price of a home in the U.S. is now below $178,000, which is 12.5% below year ago levels.

In our local market, overpriced homes are requiring far more than a 4% reduction in price before selling. In September, the overpriced homes required on average a 21% price reduction before selling.

Almost half of the homes are well-priced right now. To buyers of these homes, the tax credit is making a difference. Whether it is making enough of a difference to convince Congressional leaders will be played out this week.

There are two proposals that may be considered this week. This first, offered by Senators Dodd and Isakson, is an extension of the credit through the middle of next year. It would also expand the credit to all buyers of a primary residence. The total cost of this proposal would be $16.7 billion.

The second proposal, offered by Senate Majority Leader Reid, would extend the credit through the end of next year. It would apply only to first-time buyers. The amount would remain at the existing $8,000 (or 10% of the purchase price, whichever is less), but it would phase out $2,000 each quarter throughout 2010. The lower cost of this proposal is one of the reasons it is emerging as the favored proposal.

Regardless of the direction, it should be an interesting week on Capitol Hill.

Click image to enlarge.

Statistics compiled by Coldwell Banker Evergreen Olympic Realty, Inc. from the NWMLS database. Statistics not compiled or published by NWMLS.

Friday, October 23, 2009

You're Invited!

A developer will present its concepts for redevelopment of the NorthPoint District. This waterfront property is located on Marine Drive at the northern tip of the Port Peninsula in downtown Olympia. NorthPoint features spectacular views of Budd Inlet and the Olympic Mountains.

·See proposed development concepts for NorthPoint

·Meet the developer and ask questions

·Provide the Port with your input and comments

TUESDAY October 27, 6:30 p.m. to 8:30 p.m.

The Lacey Community Center

6729 Pacific Avenue SE Olympia, WA 98503

WEDNESDAY October 28, 6:30 p.m. to 8:30 p.m.

The Olympia Center

222 Columbia Street NW Olympia, WA 98501

THURSDAY October 29, 6:30 p.m. to 8:30 p.m.

Tumwater Comfort Inn

1620 74th Avenue SW Tumwater, WA 98501

For More Information Contact:

Heber Kennedy

360.528.8070

http://www.portolympia.com/about/northpoint

Monday, October 19, 2009

Family Fun, Pumpkin Patches & More

Don’t forget to wear your scariest costume Halloween night! There are plenty of safe and fun places to pick from for your Trick-or-Treating entertainment. Want to be scared? We have the list for frightening Haunted Houses and Mazes that will have you shaking in your boots.

“The Thurston County Scare” at Thurston County Fair Grounds - http://www.co.thurston.wa.us/fair/tc-scare-info.htm

“Howl-O-Ween” at Wolf Haven –

http://www.wolfhaven.org/howlOween.php

“Halloween Family Fun Night” at Westfield Capitol Mall - http://westfield.com/capital/specialoffers/HalloweenFamilyFunatWestfieldCapital.html

“Halloween Extravaganza” at Briggs Community YMCA - http://www.southsoundymca.org/pages/get-involved/events-calendar.php?searchresult=1&sstring=Briggs+Halloween+Extravaganza

Halloween safety website -

Monday, October 12, 2009

Group to Recognize Philanthropic Leaders in our Community

One unique thing about our community is a cooperative association of many of the local non-profits that put the donated time, treasure and talents to good work.

The South Sound Partners for Philanthropy is a consortium of 34 local non-profits whose mission is to raise awareness for philanthropy in our community.

In these economic times when charitable giving is so desperately needed, it is great to see this group working together to help the cause. It is a competitive thing going after charitable dollars and donated time, so it is nice to see a group that works to advance the cause of philanthropy in general. This group clearly knows that a rising tide lifts all boats. We appreciate your efforts.

One way the group promotes giving back is by recognizing those who give. Every year the group comes together for the Leadership in Philanthropy Awards, which will be held early next month. The awards honor groups and individuals who demonstrate outstanding philanthropic efforts in our community.

We want to also acknowledge the outstanding community citizens who are being recognized at this year’s awards ceremony. Their work inspires us to keep up our own philanthropic endeavors. This year’s recipients are:

Berschauer Phillips Construction Company (Business of the Year - Large);

McKinney’s Appliance, Inc. (Business of the Year – Small);

Zonta Club of Olympia (Philanthropic Group of the Year);

Kimberly and Charles Ellwanger (Individual/Couple of the Year);

Kim Vivian (Young Philanthropist); and

Tom and Elsa McLain (Inspirational Award).

Thank you, award recipients, for your great work. As a past recipient of Business of the Year, we know what an honor it is to be recognized. We also know that it is not the accolades that these people seek but just the feeling of making a positive contribution to this great community. Congratulations!

For more information about the South Sound Partners for Philanthropy visit http://www.celebrategiving.org/.

Friday, October 9, 2009

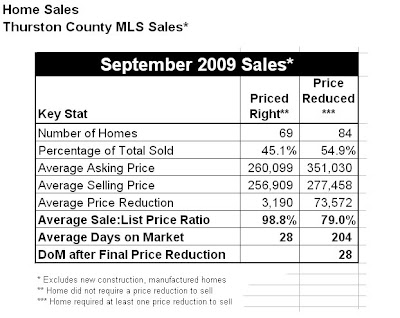

The Real Impact of Pricing Right

And time, as the old saying goes, is money.

With the torrent of down news about the housing market over the past couple of years, most people would expect that all homes are languishing on the market, just praying for a buyer to appear.

The market as a whole is certainly moving much slower than it did a few years back. The average market time for existing home sales now stands at 125 days, which is nearly two months longer than at the peak of the market in 2006.

But that picture alone is a bit deceiving. A more detailed look at today’s market reveals quite a different picture.

When we separate September 2009 homes sales into categories of those that required a price reduction before selling (overpriced listings) and those that did not (well priced listings), we find that the well priced listings are selling in just 28 days. This is 17 days faster than well priced homes sold in the summer of 2006, the peak of the recent boom market.

If you regularly follow our blog, you know that well priced homes have been selling at this pace for most of the year. Today’s buyers realize that these well priced homes are at levels of affordability that haven’t existed for some time. They are jumping to take advantage of both the lower prices and very low interest rates.

A different story emerges for the overpriced listings. They averaged 204 days on market. After six months on market, these homes are requiring an average price reduction of 21%. They are then selling in an average just 28 days once they get to the correct price.

That extra six months on market hurts in a couple of ways. First, these homes end up selling for less than they could have if they had just started off priced right. Our market, like all others around the country has seen declining prices over the past two years. Since the peak in prices in 2007 the average sales price has dropped about one-half a percent per month. That means the six months of extra market time cost the seller an additional 3%. This amounts to $7,938 for the average priced home ($264,600).

The second concern is the extra months of mortgage payments. The typical seller only receives a financial benefit on about half of the mortgage payment. The other half is lost. And the amount is significant.

The average time in a home before selling is six years. In the sixth year of a 30-year fixed rate mortgage at 5.5% interest, only 26% of the payment goes toward principal. The tax write off of the interest portion of the payments (for a tax payer in the 28% bracket) brings that benefit up to 47% of the mortgage payment. That means that 53% of the mortgage payment does not bring any financial benefit to the seller. On the average priced home, this costs the seller an additional $8,000.

So the financial impact of pricing the home right is significant. The emotional impact is also huge. Six additional months of keeping the home in show condition, of the feeling of being in limbo, and missing the chance to move to that next home that better suits the seller’s current needs are also a big part of the equation.

More and more sellers are beginning to understand these factors. Last month, 45% of sellers priced their homes right and sold in an average of just 28 days. Still not a majority of sellers, but the percentage is up significantly since the start of the year. In January, only 29% of sellers priced right from the start.

The overpriced sellers should not beat themselves up too much. In a changing market, it is sometimes hard to know what the right price is. Sometimes it takes entering the market to get feedback from buyers to know if the price is right. The key to finding the right price in those instances is to quickly review the market feedback and then make a swift price adjustment to bring it in line with the market. When done, our market’s steady activity tells us these sellers will find a ready and willing buyer.

Click image to enlarge.

Statistics compiled by Coldwell Banker Evergreen Olympic Realty, Inc. from the NWMLS database. Statistics not compiled or published by NWMLS.

Thursday, October 8, 2009

Mortgage Rates: How Low Can They Go?

These are the lowest the rates have been since mid-May, and very near the all-time low of 4.78% established in April 2009.

Rates on the 15-year fixed rate mortgage averaged 4.33%, with average points and fees of 0.7. This is the lowest the 15-year rate has been since Freddie Mac began tracking the data in 1991.

See our post on October 2nd, entitled Lower Interest Rates Keep More Money in Borrowers Pockets, for more about these lower rates and refinancing an existing loan.

Monday, October 5, 2009

Pending Home Sales Jump Again, Closed Sales Holding Steady

September’s performance brings the string of positive gains in pending sales to five months. For the year, pending sales are up 5.7% over 2008.

There are several factors leading to the increase: (1) interest rates, (2) the first-time home buyer tax credit, and (3) lower home prices.

As we reported last week, interest rates are approaching their record lows set earlier this year. Those rates are driving down the cost of ownership and buyers are recognizing the opportunity.

The first-time home buyer tax credit is also spurring activity amongst that set of buyers. The looming expiration of the credit (must close by November 30, 2009) is urging these buyers to act quickly. By some estimates, nearly 1.8 million home buyers will qualify for the tax credit.

Of all the positive forces in the market, however, none is bigger than price. Where a home is well-priced, we are seeing it move in record time. When the home is not well-priced it languishes on the market for months longer. Even then, it sells only after reducing to the right price. See our post later this week entitled The Real Impact of Pricing Right.

The median sales price for a Thurston County home is $242,900 this year, down 5.5% from 2008. Median sales price is down 11.5% across the 19-county area, which includes most of Western Washington, covered by the Northwest Multiple Listing Service.

As a signal that fewer pending sales become closed sales is the fact that closed sales are down 11.4% this year. The greatest obstacle to closing pending sales comes from the bank-owned and short sale properties, which accounted for 26% of our market’s sales in August. Lenders on short sales are taking anywhere from two to four months to make a decision on approving or denying the sale. It would seem that more are denied than approved given that there were only 13 short sales in August compared to 44 bank-owned homes sold.

Despite the challenges with bank-owned and short sale properties, momentum is picking up in the market. Closed sales over the past few months more closely match the 2008 results. September closed sales totaled 260, just 4 sales fewer than September 2008.

The pace of sales is slowly but steadily absorbing the excess inventory of homes on the market. We are now at 6.7 months supply of homes for sale, which is still a buyer’s market but the lowest since this time last year. The return to better balance will bring back longer-term sustainability in our market.

Friday, October 2, 2009

Lower Interest Rates Keep More Money in Borrowers Pockets

That drop means real savings for homebuyers. For example, someone borrowing $300,000 would save $1,450 per year with an interest rate of 4.94% versus 5.59%. That savings equates to nearly one full mortgage payment (principal and interest).

At 5.59% the monthly principal and interest payment on the $300,000 loan would be $1,720. At the 4.94% rate, the monthly payment would be just $1,599.

If you are considering a refinance of an existing loan, there is more to think about than just the monthly savings. Balanced against the lower monthly payment is the cost the lender charges for the refinance loan.

The cost of the loan should then be compared to the monthly savings along with the length of time you plan to stay in your home. If you plan to stay long enough for the monthly savings to outweigh the upfront costs, then the refinance might make sense. If you plan to move soon, the costs may greatly outweigh the savings.

Thursday, October 1, 2009

Interest Rates take another drop, approaching record lows

The average rate now stands at 4.94%. That is the lowest level since May 28th, and approaching the record low set on April 30, 2009. A year ago the average rate stood at 6.10%.

It is important to remember that these rates are just averages. Actual rates will vary for each home borrower depending on loan type, size of down payment, and the borrower’s credit score, among other things.

Besides the interest rate, a borrower should keep an eye out for the fees and points that a lender is charging for the loan. Along with interest rate, those fees and points combine to make up the actual cost of the loan reflected in the Annual Percentage Rate or APR.

According to the PMMS, the average fees and points charged on the 30-year fixed rate loan is holding steady at 0.7, which is where it has been for most of the year.

Visit http://www.freddiemac.com/pmms/ for additional information on the history of mortgage rates.

Friday, September 25, 2009

August U.S. Home Sales Down, Inventory too

Across the U.S.:

At the end of August there stood an 8.5 month supply of existing homes for sale across the U.S., down from the 9.3 month supply in July. This improvement occurred despite homes sales easing during the month.

Sales of existing U.S. homes dropped in August 2.7% to a seasonally adjusted annual rate of 5.10 million units. The pace of sales in July was 5.24 million. Analysts had expected August to return closer to 5.4 million units.

The drop in inventory is a good sign that the market is still moving back toward more sustainable levels. A balanced market will be reached when inventories return to a six month supply.

The inventory of unsold homes is 16.4% lower than year ago levels, due mainly to four consecutive months of sales gains from April through July. During that time, sales had jumped 15.2 percent.

Besides the increase in sales, builders have taken a more measured approach to bringing new homes on the market. New construction inventories, 262,000 units at the end of August, are at their lowest levels since 1992. This is also a factor in moving toward better balance in the marketplace.

Thurston County:

Locally, home inventory reached a 6.7 month supply at the end of August. While this still represents a Buyer’s market, it is improved from July where a 7.4 month supply existed. The August number represents the lowest level since September 2008. The big improvement was due to the jump in August home sales, which were up 12.2% from a year ago.

While the overall market is trending in the right direction, some segments within the market are still struggling. For example, the $800,000 and above price range had a 52.6 month supply of homes. This means that if no additional homes came on the market it would take nearly four and a half years to sell all the homes at the current pace of sales.

Sales in that upper price range are off 81% from a year ago. There have been only 4 MLS sales in this price range year to date. During the same period last year there were 21 sales.

Most of the positive movement in the market remains at the lower price ranges. The under $200,000 price range has only a 5.5 month supply of homes, making it a balanced market. Not surprisingly, sales in this price range year to date are up 38% compared to the same period in 2008.

In other price ranges, sales are off 19% in the $200,000-$299,999 range, off 16% in the $300,000-$399,999 range, off 33% in the $400,000-$499,999 range, and off 47% in the $500,000-$599,999 range.

Statistics compiled by Coldwell Banker Evergreen Olympic Realty, Inc. from the NWMLS database. Statistics not compiled or published by NWMLS.

Monday, September 21, 2009

Perspective on Positive Housing Numbers

Sales in August 2008 were the lowest level that month had seen since 2000. So the big percentage uptick this August puts us back to August 2001 levels.

No one is saying that the increase in sales is not welcomed, but we are a long way from a “normal” year in sales.

Prior to the recent boom market, the number of sales grew by an average of 5.9% per year. Applying that rate of growth to our market from 2002 (the year before the boom started) onward, we’d expect to have 4,334 sales by year end. Instead, our market is on pace to have 2,544 sales. That seems like quite a big gap.

However, during the boom years, sales far exceeded the number historically seen. Since 2001, we have 32,053 sales. The numbers of sales we’d project for that time would have been just 31,356. (See Chart 1 below).

Click image to enlarge.

So even with a huge drop off in sales the last two years, our market is still pacing longer-term projections. What’s the old saying, biting off more than can be chewed? The numbers mean that our market is finally absorbing the excess sales bitten off during the peak.

What this means going forward is that we are returning to more sustainable times in our market. While it is too optimistic to think we’ll get back to our trend line for sales next year, nearly 4,600 sales, we should see more sales as demand is now becoming pent up.

However, demand will not be robust enough to overcome still overpriced properties. Prices, while off 12.8% from the peak, are still above our historic trend line (See Chart 2 below).

Click image to enlarge.

As we’ve reported before, expect average prices to continue to come down (see our September 10, 2009 post). As they do, we will see more buyers enter the market.

In fact, buyers are active today, jumping quickly on well priced homes. According to our latest market study, homes that did not require a price reduction before receiving an offer are going under contract in just 27 days. That is 18 days faster than the peak of our seller’s market.

Price is still the key to our market’s normalization. Read this interesting article for some additional perspective: http://www.cnbc.com/id/32420604/.

Statistics compiled by Coldwell Banker Evergreen Olympic Realty, Inc. from the NWMLS database. Statistics not compiled or published by NWMLS.

Thursday, September 10, 2009

Washington vs. the U.S., Why Our Area’s News May Not Match the Rest of the Nation’s

In our blog we have even been reporting our area’s share of positive news. After a couple of years of consistently tough news, these positive signs are certainly welcomed. However, our local market overall is still in a correction mode – and we expect to trail the rest of the nation in the housing recovery. The reason is that our market was late to begin its correction.

While much of the rest of the country, including the hardest hit states, started to correct in late 2005 and early 2006, our market remained strong until the summer of 2007.

Several factors helped our market delay the correction – a strong job base and low unemployment, significant inbound migration to the state, and a lot less overbuilding than occurred in places like California, Nevada, Arizona, and Florida. In addition, our region’s property values did not jump as high as these other states. For example, from 2000 through 2006, California’s median home price jumped an astounding 124.5%. Washington’s median price increased 72.5% during the same period (Source: www.FHFA.gov).

While our price increases were nowhere near California’s, the appreciation was still far above our historical levels of growth. We would have expected just 41% average price appreciation from 2000 through 2006, based on our local area’s historic price appreciation prior to the 2003-2006 seller’s market (5.9% per year).

Ultimately, our level of price appreciation proved too much, pushing well above the level of sustainable demand. This triggered our market’s correction in the second half of 2007, a full 18 months after most of the rest of the nation.

Given that our market did not fly as close to the sun as places like California, we might not be a full 18 months behind that state when it comes to marking our bottom. However, we are certainly going to lag behind.

Chart 1 below shows the price history of a $200,000 home purchased in the year 2000. California’s trajectory is much more extreme than Washington’s. California prices have now corrected below its historic trend line of price appreciation. This significant drop reflects the serious oversupply of homes that persisted there over the past several years.

Click image to enlarge.

Now that prices and supply are down, home sales there are bouncing up. According to the California Association of Realtors, in 2008 California experienced a 26.8% increase in sales of existing homes. There is a 25% increase expected this year. That market is returning to more sustainable times.

For our part, Thurston County remains above its historic trend line for price appreciation despite two years of price declines. Chart 2 shows that our average price is still almost 6% above expected levels.

Click image to enlarge.

Still, more and more sellers are pricing their homes right to reflect today’s reality. We see everyday that even though the market overall is still correcting an individual home may already be at its market bottom. This is reflected in the 12.2% uptick in home sales during August. Buyers are clearly recognizing the value of these well-priced homes and they are acting quickly to buy them. See our July 30, 2009 post.

The key is getting back to relative affordability in all price segments. Many price segments, such as under $250,000, are at levels of affordability not seen in more than five years. Other market segments are still overpriced.

The Federal Housing Finance Agency’s quarterly report ranking 297 U.S. cities for price appreciation shows that we are behind the rest of the nation in price adjustments. The report ranks cities’ price gains over the past 5 years, one year, and latest quarter. Olympia ranks 11th best for price appreciation over the past 5 years. That number is simply unfathomable. We are a great area, but number 11 in the country?

Just nine months ago our ranking was 12th on the list, but don’t take that as a sign that things are improving. Rather it shows how much the rest of the country has fallen. Our 12th place ranking last year was the result of almost 61% price appreciation over the previous 5 years. Our 11th place ranking this year reflects just 39% price appreciation over the past 5 years. So in three quarters we’ve dropped 22% points of price gains.

Earlier this decade, we ranked closer to the bottom of the list, with a ranking in the bottom 15% of the nation. (See Chart 3 below). We should not expect to stay in the top 3% of the country. And, in fact, the change is already happening. Olympia’s ranking for price appreciation over the last year is 213th, and over the last quarter is 237th.

Click image to enlarge.

The data shows that our market’s correction was simply late in starting. We will continue to correct and settle out in more sustainable territory.

So as we continue to hear positive news coming from around the nation, you’ll know that our local market news will continue to lag until next year. Further proof, once again, that all real estate is local.

Statistics compiled by Coldwell Banker Evergreen Olympic Realty, Inc. from the NWMLS database. Statistics not compiled or published by NWMLS.

Wednesday, September 9, 2009

Mortgage Rates Down Again

Mortgage rates are one of the main reasons that housing sales are starting to improve. Combined with lower home prices, these rates have greatly increased affordability. Buyers have responded by moving sales of homes in Thurston County up 12.2% in August 2009 compared to year ago numbers.

Source: http://www.freddiemac.com/pmms/#Historical

Click image to enlarge.

Click image to enlarge.

Friday, September 4, 2009

With Prices Down, August Sales Jump Up

This is only the fourth month out of the last 32 where a positive gain in sales has been posted. The other three months with sales gains were only slight percentage upticks. We have to look all the way back to December 2006 to find the last 12% gain in sales.

Price reductions have put affordability levels at the highest levels in decades. Add attractive interest rates and an $8,000 first-time buyer tax credit, and we have buyers coming back into the market.

Pending sales, which are an indicator of sales a month or two down the road, were up 5.9% year over year in August. That is a nice gain but off the big 14.7% jump experienced in July.

Our market will need a string of months like August if we are to get back to a truly balanced market. That is because inventory levels still place us squarely in a buyer’s market with just over a seven month supply of homes for sale.

Prices will continue to correct down until we are back in a balanced market, which has a four to six month supply of homes.

Thurston County’s year to date median price has fallen 6.5% from last year. It now stands at $243,000 compared to $259,900 last year.

Even with these price adjustments, the market as a whole is still above its historic trend line for price appreciation (see our July 28, 2009 post for more on prices). We expect prices will continue to moderate through the spring of next year and then start a slow recovery.

The big jump in home sales last month, however, is a clear reminder that each home has its own price bottom. Buyers are gobbling up the well-priced homes. The still overpriced homes are being ignored until prices are reduced (for more on this topic see our August 18, 2009 post).

More and more sellers understand the need to get the price right now. In July, 41% of sellers sold without needing a price reduction. Only 29% of sellers at the start of the year started with the right price. Buyers are starting to learn that if they wait for a “market” bottom they may just miss out on the home of their dreams that is already on its way back up.

Next week: Prices are starting to inch up around the country, why not here. Learn why our market will continue to lag behind the rest of the country as we come out of the housing slump.

Wednesday, September 2, 2009

U.S. Pending Home Sales Reach 2-year High

The Index is 3.2% higher than the June reading, and it is 12% higher than July 2008. July was the sixth straight month with an increase in pending sales. In the eight year history of the Index, there has never been such a string of positive up ticks.

As we reported early last month, Thurston County pending sales continue to outperform 2008 levels. In July, pending sales increased 14.7% over July 2008.

For more on our local pending sales, see our August 6, 2009 posting. Later this week, we will have a report on August pending home sales.

Monday, August 31, 2009

Why a drop in Building Permits Bodes Well for our Market

Residential building permits are down across the country, and that is a good thing. The supply of homes on the market is already over 7 months (4-6 months supply indicates a balanced market).

Builders are clearly responding to the oversupply by moderating the pace of new construction. While we have a ways to go yet, this is helping to bring our market out of the doldrums and back to more sustainable times.

http://www.theolympian.com/southsound/story/954635.html

Thursday, August 27, 2009

Coldwell Banker Ranked Highest in Seller Satisfaction

The survey examines four factors among in the home-selling process: (1) agent, (2) marketing, (3) office, and (4) package of additional services. The results of the survey showed that Coldwell Banker performs “particularly well in all four categories.”

Wednesday, August 26, 2009

Sales of New Homes on the Rise

This is the highest rate of sales since last September, and it is the largest percentage increase since early 2005, which was the peak of the nation’s housing boom.

The standing inventory of new homes fell to a 16-year low. That reflects both the increase in sales and the fact that builders have put the breaks on new starts.

At the current rate of sales, there is now a 7.5 month supply of new homes. This is down sharply from the beginning of the year when more than 12 month supply of homes sat on the market. A balance market is one that has between four and six month supply.

Locally, pace of new home sales is lagging behind the national trend. We are seeing a slight uptick in activity with July sales 4.4% up from a year ago. Most subdivisions are averaging a couple of sales each month, which reflects a more normal pace of sales for our market.

There is certainly a lot less new construction coming on the market. As of July 31, 2009, there were 416 new construction listings in Thurston County, down 28% from the 581 listings in July 2008.

Like the rest of the market, price is really dictating the pace of sales. Those new homes that are priced well compared to the competition, both new and existing homes, are selling well. Also, homes in the more affordable space under $300,000 continue to outperform the homes priced above that level.

The average list price of a Thurston County new construction listing is now $302,493, down $63,862 from the same time last year.

Statistics compiled by Coldwell Banker Evergreen Olympic Realty, Inc. from the NWMLS database. Statistics not compiled or published by NWMLS.

Friday, August 21, 2009

Existing Home Sales Surge

It is the fourth month in a row that sales have increased, marking the first time since June 2004 that we’ve had such a string of positive gains.

Year over year sales are also up. In July 2008, we had a 4.99 million unit pace of sales. We have to look all the way back to November 2004 to find the last time we had a year over year gain in nation-wide sales.

The sales gains were not evenly shared around the country. Some areas are seeing bigger gains than others. The Northeast jumped 13.4%, the Midwest is up 10.4%, the South rose 7.1%, and the West is down 1.7%. All areas were ahead of July 2008 levels.

There is one simple reason for the surge in activity – price. Regular followers of our blog will know that we routinely discuss price and how it is the solution to getting housing going again.

For a long time prices have been well above current levels of supply and demand. When that happens, buyers simply do not purchase. Now that prices are coming back to match the supply-demand picture buyers are back.

The national median sales price for existing homes is down 15.1% in from the same period a year ago. Prices are down 32% from the peak in 2006.

The lower prices have made the home price to income ratio the best it has been in years. This means homes are affordable again. And affordability is the key to stability and sustainability in housing.

The emergence of the subprime, adjustable-rate or interest-only loan products earlier this decade created a false sense of affordability. The return to predominately fixed-rate lending coupled with lower home prices is creating a more sustainable base of homeowners who will now know they can truly afford their homes over the long-haul.

Even with the brisker pace of sales, there are still enough houses for sale to keep us squarely in a buyer’s market. The inventory of unsold homes in the U.S. stands at a 9.4 month supply. However, supply has dropped by two months in just a year.

Locally, our supply is just below 7.4 months. A balanced market has a four to six month supply of homes for sale, and we are definitely trending back toward that kind of market.

For the latest on July 2009 sales in our local market, read our August 6, 2009 blog post.

Click image to enlarge.

Statistics compiled by Coldwell Banker Evergreen Olympic Realty, Inc. from the NWMLS database. Statistics not compiled or published by NWMLS.

Thursday, August 20, 2009

Men vs. Women

Coldwell Banker just completed an interesting survey of 1,000 individuals to learn how men and women differ in the home-buying process. One result – women are a bit more decisive than men.

According to the report “when asked how long it took before they knew their home was ‘right’ for them, almost 70 percent of women had made up their mind the day they walked into the house, vs. 62 percent of men. Conversely, significantly more men needed two or more visits: (32 percent of men vs. 23 percent of women).”

View the entire Press Release and Video at: http://coldwellbanker.com/servlet/News?action=viewNewsItem&contentId=14521585

Mortgage Rates Drop Again

Click image to enlarge.

Great Community Event this Weekend

Hosted by the Hands On Children’s Museum, the event showcases some outstanding sand sculptures built by local businesses and organizations. The three-day event starts with sand sculpting tomorrow (8/20) and continues with family activities all day Saturday and Sunday.

The event is free to the public, but donations are welcomed to help support children’s programming. Come out and enjoy the fun and support this great children’s organization.

Below are photos of our company’s previous sand sculpture entries.

Three Little Pigs (Golden Shovel Winner 2003)

Click image to enlarge.

Winnie the Pooh (Silver Medal Winner 2004)

Click image to enlarge.

Wednesday, August 19, 2009

Foreclosures Filings Dropping Dramatically

Click image to enlarge.

This dramatic drop in rate may not last long. The biggest set of adjustable rate subprime mortgages originated in our market happened from summer of 2005 through 2006. The majority of those loans came with low rates fixed for 3 years. The last wave of those loans will reset at much higher rates over the next few months.

For interesting related story on the national foreclosure picture visit: http://www.cnbc.com/id/32449645/site/14081545

Statistics compiled by Coldwell Banker Evergreen Olympic Realty, Inc. from the NWMLS database. Statistics not compiled or published by NWMLS.

Tuesday, August 18, 2009

More Sellers Needing Price Reductions

The study shows that the average price reduction was 10% from the top list price, which equates to a $40,173 price reduction.

Locally, we are seeing that the majority of sellers had to take on one or more price reductions before getting the home sold. In our study of Thurston County home sales for July 2009, we found that 58.9% of sellers needed a price reduction before selling. The average percent price reduction was 20.1%, or $63,298.

Click image to enlarge.

The fact that a greater percentage of local sellers needed price reductions might be explained by the fact that our market’s correction started about 18-24 months after most of the rest of the nation. Sellers outside the northwest have had longer to come to terms with the market changes and the need to reduce prices to match the level of demand.

As high as our local numbers are they are actually improving quite a bit. In January and February, nearly 71% of sellers had to reduce their price before finding a buyer.

Remarkably, even at the peak of our market in the summer of 2006, 41% of sellers needed price reductions before selling, which shows that even in the most active seller’s market we’ve ever seen it was still possible to overprice a home.

Statistics compiled by Coldwell Banker Evergreen Olympic Realty, Inc. from the NWMLS database. Statistics not compiled or published by NWMLS.

Thursday, August 6, 2009

Thurston County Pending Sales Rise Again Closed Sales Fall a Bit

The number of closed home sales in July 2009 was down 6% from a year ago, logging 282 sales versus 301 in July of 2008. After June sales posted only the third year-over-year increase in two and a half years, it is disappointing to see fewer sales in July.

However, a more important indicator of the market’s future performance is pending home sales. Pending sales are contracts that are accepted by a seller but have not yet closed. They represent the most current activity and show how active buyers are in the market. Thurston County pending sales increased 14.7% in July, jumping from 339 in July 2008 to 389 this year.

We are now seeing a trend emerge as monthly pending sales continue to best last year’s numbers. This is a good sign that buyers are active in this market. They are jumping back in as prices have become more affordable, helped by low interest rates and tax incentives for first-time buyers.

The difference in the performance of closed and pending sales is primarily due to the fact that many sales are simply taking longer to close. Short sales, where the net proceeds to the seller will not cover the outstanding debt on the property, are taking 60 to 90 days to close as the buyer and seller must wait for the bank to approve the sale.

Another factor in the difference is that many of the pending short sales never become closed sales because either the bank does not approve the sale or the buyer loses patience waiting for bank approval. Short sales account for at least 10% of our area’s pending sales activity.

The biggest influence in our market’s overall performance, however, continues to be price. To the extent a home is priced well it is selling. Year to date, our area’s average sales price is $264,851, which is down slightly more than 8% from a year ago and 12% off the peak a couple of years ago.

Depending upon location, condition, and amenities, some homes are requiring far more than an 8% reduction, while others are fairing better than the average. Because each house is unique, each has its own pricing story.

As we have reported in the past, that drop is simply bringing us back to our market’s historic trend line for price appreciation. While our market is not out of the woods yet, its path to recovery has been much less severe than some of the hardest hit places in the country.

Statistics compiled by Coldwell Banker Evergreen Olympic Realty, Inc. from the NWMLS database. Statistics not compiled or published by NWMLS.

Thursday, July 30, 2009

Foreclosure News

Some of the nation’s largest cities, which had high foreclosure rates over the past few years, have finally seen a year over year decrease. New York dropped 23.5% in the first half of 2009 compared to 2008. Boston saw a 40.7% decrease and Washington D.C. fell 9.6%.

What might cause some alarm with local folks is the percentage increase in markets closer to home. Seattle, for example, experienced the largest percentage gain of any U.S. city – increasing 72%. That figure might be shocking on its face, but pulling back the curtain reveals a number that is relatively tame; just 1 in 107 properties received a foreclosure notice. By comparison, Las Vegas, one of the worst foreclosure spots, had 1 in 13 properties issued a foreclosure filing.

It is also important to remember that the Pacific Northwest’s housing market remained strong well after the rest of the nation started correcting. So while other parts of the country will start to report positive upward ticks before our area will. We should expect to see our negative foreclosure numbers continue for another 9-12 months before they begin to swing the other way.

Even over the next year we don’t expect to see a downward correction as steep as those hard-hit Sun Belt states. Those places experienced much higher highs and thus had further to correct. See related post on December 3, 2008.

Locally, Thurston County has had 1,114 foreclosure filings in 2009 (through July 24th). The county has more than 100,000 housing units, so our number, like Seattle’s, is relatively low. But at nearly 40 filings a week, our levels are twice as much as we’d expect in a balanced market.

Click image to enlarge.

Bank owned and short sale homes accounted for 22% of all Thurston County existing single family home sales in the month of June. That was the lowest percentage since last October.

Click image to enlarge.

Statistics compiled by Coldwell Banker Evergreen Olympic Realty, Inc. from the NWMLS database. Statistics not compiled or published by NWMLS.

Well Priced Homes Selling in Record Time

Despite the news that home sales are generally down, buyers are out there in significant numbers. They are just waiting to see the right price. When they see it, they are jumping quickly.

Well priced homes, those that did not require a price reduction before selling, are selling in just 28 days. That is the fastest pace of any quarterly period since we started the report in 2005. During the market’s frenzied peak in 2006, the well priced homes were selling in 45 days.

Click image to enlarge.

The dramatic difference in days on market shows that buyers are recognizing the tremendous affordability that many homes offer today. Affordability in our market is at a five year high.

Even while there are great opportunities, buyers are also recognizing that there are many homes that are over priced. Nearly two-thirds of the homes sold in the second quarter required at least one price reduction before selling. The average percentage price reduction was 17.6% before selling. Those homes sat on the market for a record average time of 200 days. When they were reduced to the final price they sold in just 30 days, nearly the same time that well-priced homes averaged.

See related post on June 26, 2009.

Statistics compiled by Coldwell Banker Evergreen Olympic Realty, Inc. from the NWMLS database. Statistics not compiled or published by NWMLS.

Tuesday, July 28, 2009

U.S. Home Prices have 1st Gain in 3 Years

The Standard and Poor’s/Case-Shiller Index for May reports a 0.5% increase in home prices from April. The report tracks prices in 20 major metro markets around the country. 13 of those 20 cities experienced increases in prices. While one month of positive pricing news does not a trend make, the large number of markets that showed gains is a good sign.

Some markets are fairing better than others. Boston, Dallas, and San Francisco all saw gains of more than 1%. Two of the country’s hardest hit markets, Las Vegas and Phoenix, were still dropping, down 2.6% and 0.9%, respectively.

The two cities in the report closest to Thurston County, Seattle and Portland, reported a change of -0.3% and 0.1%, respectively.

Locally, market wide home prices are still correcting. The average price dropped in June to $261,386, down 2% from May. In June of 2008, our average price was $279,543.

The correction in our local housing market started some 18 months after the rest of the nation, which means we might lag the positive news coming out of the rest of the nation. Many of the hardest hit parts of the country have seen, and needed to see, much more significant correction than our own market. (See related post on December 3, 2008). Perhaps now they can start to support modest gains again. The next several months’ reports will answer that question.

Looking back, we see that in many markets around the country, simply giving back the excess gains over historical trend line for appreciation was all the price correction that was needed. Once those market’s prices returned to the historic trend line sales started to perk up. In the hardest hit places, prices have dropped below that historic trend line. In places like California, there has been a huge jump in the number of sales. (See related post on July 23, 2009).

In our market, our average prices are coming back in line with our historical growth patterns. The chart below shows our actual average price versus the price taking out the bubble above our historic average annual gains. The two lines are steadily coming back together. No one can say for certain whether we will experience a technical bottom when the lines intersect.

Click image to enlarge.

However, it is important to remember that all these reports are market averages, which show the broader trends. The reports are often used to predict market-wide “bottoms.” While our local market may not yet be at its “market wide bottom”, every house has its own bottom. Many sellers are pricing their homes correctly and they are finding buyers today. Those buyers certainly aren’t waiting for the technical market bottom because they know they’d miss opportunity on those homes that are already bouncing back up.

Statistics compiled by Coldwell Banker Evergreen Olympic Realty, Inc. from the NWMLS database. Statistics not compiled or published by NWMLS.

Monday, July 27, 2009

“Really Good News” about Nationwide New Home Sales, Local New Home Sales still correcting

Perhaps a show of how low our expectations are, the sales are still 21% off June 2008 numbers. Moreover, the longer term trend shows roughly 950,000 sales per year. So we are still a long way off from more normal times.

Still it is good news as the troubles in home construction has been a big drag on the economy. Therefore, this uptick in activity is a nice signal that we might be trending back in the right direction. The nationwide inventory of unsold new homes dropped to an 8.8 month supply, which is down from 10.2 months in May.

CNNMoney.com quotes Peter Morici, a University of Maryland economics professor, as saying the housing numbers “is really good news. Considering what’s going on in existing home sales, with all the foreclosure activity sending down home prices, for new homes to jump like that is a good indicator that the economy is bottoming out.”

Housing is a leading economic indicator and much of the news over the past three months is certainly indicating more positive trends.

At the local level, Thurston County home builders have pulled construction levels way back from the peak of the housing boom in 2006. However, our market did not start correcting until 18 months after the rest of the country. That means we still have some adjusting to do.

The standing inventory of platted or preliminarily platted property remains significant. Banks are just now starting to take back tracts of land and will be looking to sell them to builders and developers in the next six to nine months.

What the buyers do with those properties will greatly influence our market for the next three to five years. Based upon today’s market, those properties are worth just a fraction of what was lent on them. If sales are structured at realistic values, much of that land can simply be land-banked to wait for a time that more housing stock is needed.

The temptation will be to start building on those properties soon for risk of losing the entitlements and the investment made to get them. To be sure, there are some plats that could be brought to market now. Some areas in our community are still under-built with certain types of housing, but most areas are way over-served. If builders and the property owners take care in distinguishing those opportunities, we will see a healthy flow of new houses to the market.

Overall, our hope is that the frenzied race to build on any old piece of land, regardless of market need, is laid to rest and that a more sustainable pace of building occurs. The posture of the credit markets and the home builders seems to indicate we are heading in that direction.

Our market is down to a 7.6 month supply of homes for sale. A six month supply is considered balanced. Even though we look better than the rest of the nation as a whole, the market is not completely healthy yet. However, the trend is certainly moving back toward balance and a more sustainable future. That is really good news for our local market.

Thursday, July 23, 2009

Housing Numbers Improve

As housing is a leading economic indicator, the stock market responded positively today to the news. All of the major markets showed sizeable positive gains. While housing is not yet out of the woods, the emerging trends are encouraging.

On the local front, we reported earlier in the month that June home sales were up over last year’s number. That is only the third time in the past 27 months that our local market has experienced a year over year increase. The return of affordability is bringing buyers back.

Establishing a new baseline of affordability has been the roadmap to recovery in other parts of the country. In the hardest hit regions of the country, California, Florida, and Arizona, average prices have returned to affordable levels and that has brought the buyers back in a big way.

Sales in California, for example, shot up 35.2% from May 2008 to May 2009. Homes there were inflated way beyond sustainable levels. Prices are off 30% from a year ago, bringing them back to affordable levels. This in turn has brought the buyers back.

The Pacific Northwest in general, and our area in particular, was about 18 months behind the rest of the nation in the market correction. We are now playing catch up. To the extent a home is priced right, it is selling. When it is overpriced, no matter what price segment the home is in, it is not selling.

Most of the sales are concentrated in the lower price segments, particularly below $250,000. In that category we still see a heavy influence of bank-owned and short sale properties. They accounted for 28% of all sales below $250,000 last month (that number climbs to 53% below $200,000). Those distressed properties are being offered by very motivated sellers who are pricing the home at today’s market values.

We still see the majority of homes, particularly at the upper price ranges, being priced above market value. Price is the one thing that is keeping our market from experiencing more sales. The buyers are out there and are willing to act quickly when they see that value. They are also showing great discipline in avoiding overpriced properties.

The good trend for our market is that more sellers understand the current environment and are pricing to it. At the start of the year, only 71% of sellers over-priced their home, meaning that they required at least one price reduction before selling. In June that number dropped to 60%. This figure is extremely important for sellers because overpriced homes are on the market an average of 203 days. Last month, homes that were priced at market averaged just 28 days on market.

Click image to enlarge.

Statistics compiled by Coldwell Banker Evergreen Olympic Realty, Inc. from the NWMLS database. Statistics not compiled or published by NWMLS.